Agincare has confirmed it has exchanged contracts to acquire two Somerset Care homes previously threatened with closure.

Social careAssura issues Social Bond

Latest News

HC-One has cited rising inflation and pressure on publicly funded fees after posting a £63 million loss in the financial year ending September 2023.

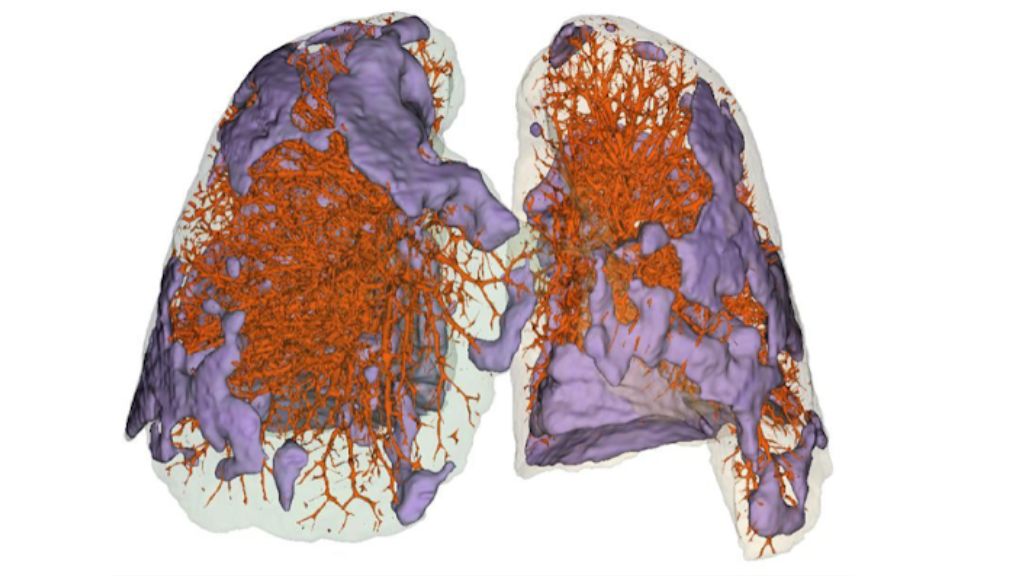

Company resultsCambridge-based techbio company Qureight has closed a “significantly oversubscribed” $8.5 million Series A funding round.

Diagnostics